Return on Net Worth (RONW) is a crucial financial metric that assesses a company’s profitability in relation to its net worth or shareholders’ equity. It provides valuable insights into a company’s ability to generate profits from its shareholders’ investments. In this comprehensive guide, we will delve into the return on net worth formula, its significance, interpretation, and how businesses can use it to make informed decisions.

What Is Return on Net Worth?

Return on Net Worth, often referred to as Return on Equity (ROE), is a financial ratio that measures the profitability of a company based on the capital invested by its shareholders. It is expressed as a percentage and helps investors, analysts, and management gauge a company’s financial performance and efficiency in utilizing shareholders’ equity.

Return on Net Worth Formula

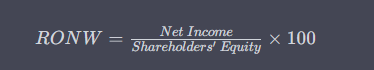

The return on net worth formula is relatively straightforward:

- Net Income: This represents the company’s profits after all expenses, including taxes and interest, have been deducted.

- Shareholders’ Equity: This includes the initial capital invested by shareholders, retained earnings, and additional paid-in capital. Essentially, it represents the book value of the company.

Significance of Return on Net Worth

- Measuring Profitability: RONW provides a clear picture of a company’s profitability. A higher RONW indicates efficient utilization of shareholders’ equity to generate profits.

- Comparative Analysis: It allows for the comparison of a company’s financial performance with industry peers or competitors. This helps in benchmarking and identifying areas of improvement.

- Investor Confidence: Investors often use RONW as a key metric when evaluating potential investments. A high RONW can attract investors, while a declining RONW may signal financial issues.

- Management Evaluation: Management teams use RONW to assess the effectiveness of their strategies in delivering returns to shareholders. It can guide decision-making and resource allocation.

Interpreting Return on Net Worth

- High RONW: A high RONW is generally favorable, indicating that the company efficiently generates profits from shareholders’ equity. However, an exceptionally high RONW may also signal a lack of reinvestment in the business, potentially hindering future growth.

- Low RONW: A low RONW may suggest that the company is not effectively utilizing shareholders’ equity to generate profits. It could be due to excessive debt, operational inefficiencies, or declining profitability.

- Consistency: Consistency in RONW over time is often preferred, as it reflects stability and reliability in generating returns for shareholders.

How to Improve Return on Net Worth

- Increase Profitability: Focus on increasing net income through cost management, revenue growth, and improved operational efficiency.

- Optimize Capital Structure: Carefully manage debt levels to avoid excessive interest expenses that can weigh down RONW.

- Retain Earnings: Reinvest profits into the business rather than distributing them as dividends, which can boost shareholders’ equity and RONW over time.

- Efficient Asset Use: Utilize assets effectively to generate revenue without tying up excessive capital.

Conclusion

Return on Net Worth is a fundamental financial metric that provides valuable insights into a company’s profitability and its ability to create value for shareholders. By understanding the return on net worth formula, interpreting the results, and implementing strategies to improve RONW, businesses can enhance their financial performance and attract investors’ confidence. It remains a key tool for financial analysis and decision-making in the corporate world.